The balance sheet is a crucial document that reflects a company’s financial health at a specific point in time. Its significance extends across various sectors, with each relying on this essential financial statement for different reasons.

Understanding this vital statement is key for investors, creditors, analysts, and internal stakeholders to assess a company’s financial position and performance. In this guide, we will delve into the complexities of a balance sheet, equipping you with the knowledge to make informed financial decisions.

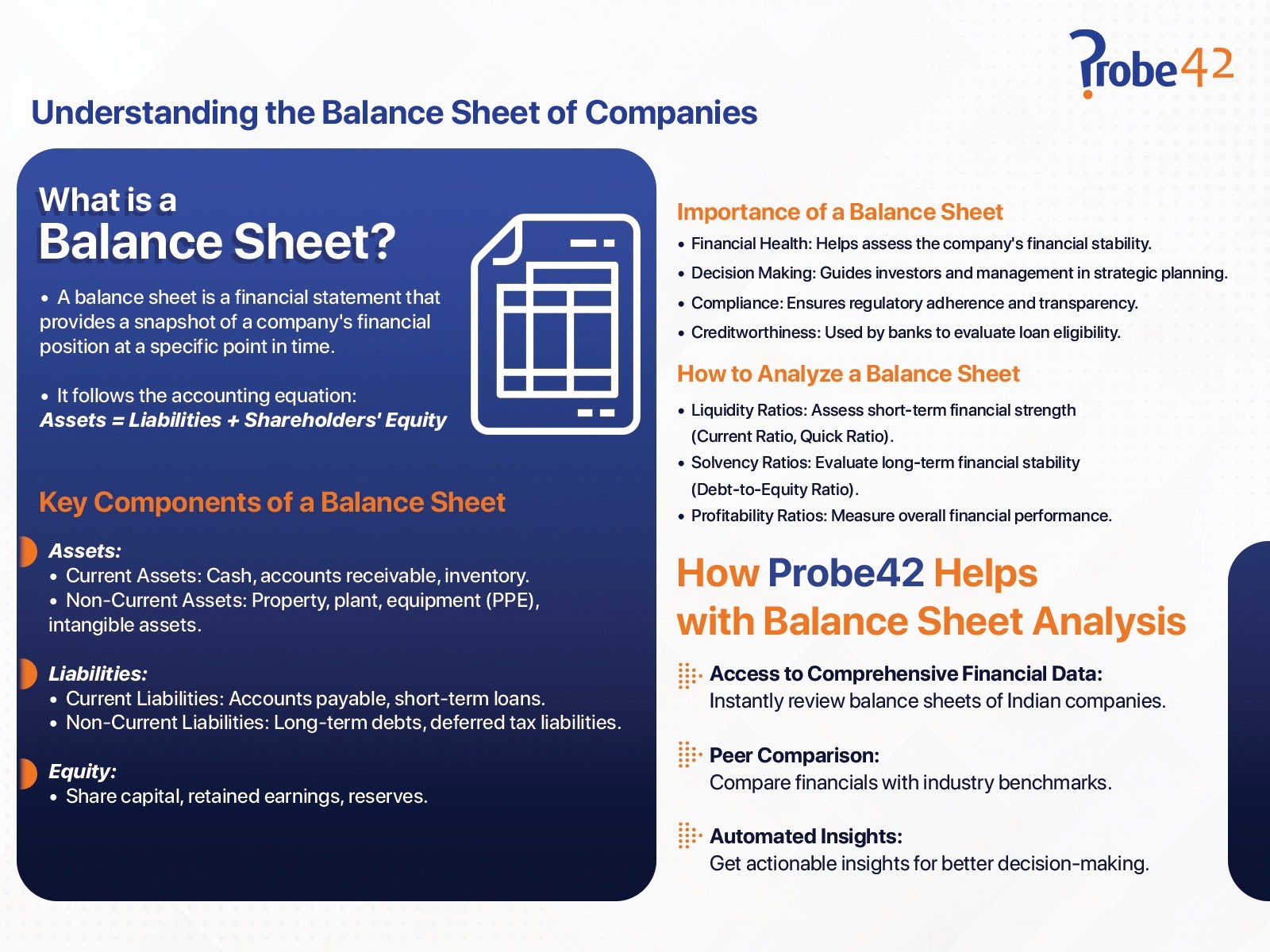

Company Balance Sheets 101

A balance sheet, often referred to as a statement of financial position, is a summary of what a company owns (assets), what it owes (liabilities), and its net worth (equity) at a given moment. This financial statement is integral to evaluating the overall financial strength and liquidity of a business.

Balance sheets of companies in India, as in many other countries, are prepared annually as part of the financial reporting requirements. They provide a comprehensive overview of a company’s financial situation, serving as a crucial tool for decision-making. By examining a balance sheet, stakeholders can assess whether a company has sufficient resources to meet its obligations and sustain its operations.

Importance of balance sheet

The significance of the balance sheet lies in its ability to provide insights into various aspects of a company’s financial health:

1. Company’s Financial Health:

First and foremost, the balance sheet helps stakeholders evaluate the financial health of a company. It provides a clear picture of the company’s assets, liabilities, and equity at a specific point in time. This information is crucial for assessing the company’s ability to generate cash flows, meet its short-term and long-term obligations, and fund future growth initiatives.

For example, investors analyze the balance sheet to determine whether a company is financially stable and capable of generating returns on their investment. Similarly, creditors use the balance sheet to assess the company’s creditworthiness before extending loans or credit lines.

2. Data-based Investment Decisions:

Investors rely heavily on balance sheets to make informed investment decisions. By examining the composition and trends in a company’s assets, liabilities, and equity over time, investors can gauge the company’s financial performance and growth potential. They look for signs of profitability, efficient asset management, and strong financial controls—all of which contribute to the attractiveness of the investment opportunity.

3. Creditworthiness:

Creditors, including banks and financial institutions, analyze balance sheets to evaluate the creditworthiness of a company. They assess the company’s ability to repay borrowed funds based on its current and projected financial position. A strong balance sheet with sufficient assets and manageable liabilities enhances the company’s ability to obtain favorable financing terms and access additional capital when needed.

4. Strategic Planning:

Internally, management relies on balance sheets for strategic planning and decision-making. By understanding the company’s financial resources and obligations, management can allocate resources effectively, plan for future investments, and optimize capital structure. Balance sheets provide valuable insights that support informed decisions aimed at enhancing profitability, managing risks, and achieving long-term growth objectives.

Components of Balance Sheets

A typical balance sheet consists of three main components: assets, liabilities, and equity. Each component plays a crucial role in defining the financial position of the company.

1. Assets:

Assets represent what the company owns and controls. They are categorized into current and non-current assets based on their liquidity and expected conversion into cash within a specific time frame.

Current Assets include cash and cash equivalents, accounts receivable (amounts owed by customers), inventory (goods held for sale), and prepaid expenses (expenses paid in advance). Non-current Assets consist of long-term investments, property, plant, and equipment (PP&E), intangible assets (such as patents and goodwill), and other long-term assets that support the company’s operations over an extended period.

2. Liabilities:

Liabilities represent the company’s obligations to external parties, including suppliers, creditors, and lenders. Similar to assets, liabilities are classified into current and non-current categories based on their maturity and repayment terms.

Current Liabilities include accounts payable (amounts owed to suppliers), short-term borrowings (such as bank loans and lines of credit), accrued expenses (expenses incurred but not yet paid), and current portions of long-term debt (principal payments due within one year). Non-current Liabilities consist of long-term debt (principal payments due beyond one year), deferred tax liabilities (taxes payable in future periods), and other long-term obligations that do not require immediate settlement.

3. Equity:

Equity, also known as shareholders’ equity or net worth, represents the residual interest in the assets of the company after deducting its liabilities. It reflects the cumulative contributions by shareholders and the retained earnings generated by the company through profitable operations.

Components of equity include share capital (amount invested by shareholders in exchange for shares), retained earnings (profits retained in the business for growth and expansion), and reserves (funds set aside for specific purposes, such as future investments or contingencies).

The balance sheet is not merely a financial statement but a cornerstone of financial transparency and accountability for any company. It serves as a compass for decision-making, offering stakeholders a clear view of a company’s assets, liabilities, and equity. By understanding and interpreting the components of a balance sheet, investors, creditors, and management can make informed decisions that drive business growth and sustainability.

Probe42, Leading Data Intelligence Tool

Probe42 is designed to streamline the process of accessing information on over 2 million registered companies in India. We collect data from 746 validated public domain sources to get the most up-to-date information. Then, this data is cleaned using fine-tuned algorithms and QA experts to make sure it is verified. Finally, we curate this highly accurate data for optimal presentation and seamless end-usage, so you can get quick access without spending hours to decipher it.

One of the key features of Probe42 is its ability to provide easy access to company financial statements and reports. With Probe42, users can efficiently retrieve financial data on registered companies, including balance sheets, profit and loss statements, and cash flow statements. Gain valuable information and insights for making informed business decisions and conducting due diligence. Learn more at: https://probe42.in/products/business.html