In the realm of business finance, cash is a critical pillar. According to The National Federation of Independent Businesses and a study by U.S. Bank, 82% of small businesses fail due to poor cash flow management. This startling statistic underscores the critical role of the cash flow statement in a company’s financial health.

By providing a detailed account of cash inflows and outflows, the cash flow statement serves as a vital tool for diagnosing financial stability and operational efficiency. In this blog, we delve into the nuances of cash flow statement analysis, exploring its importance, types, and future trends.

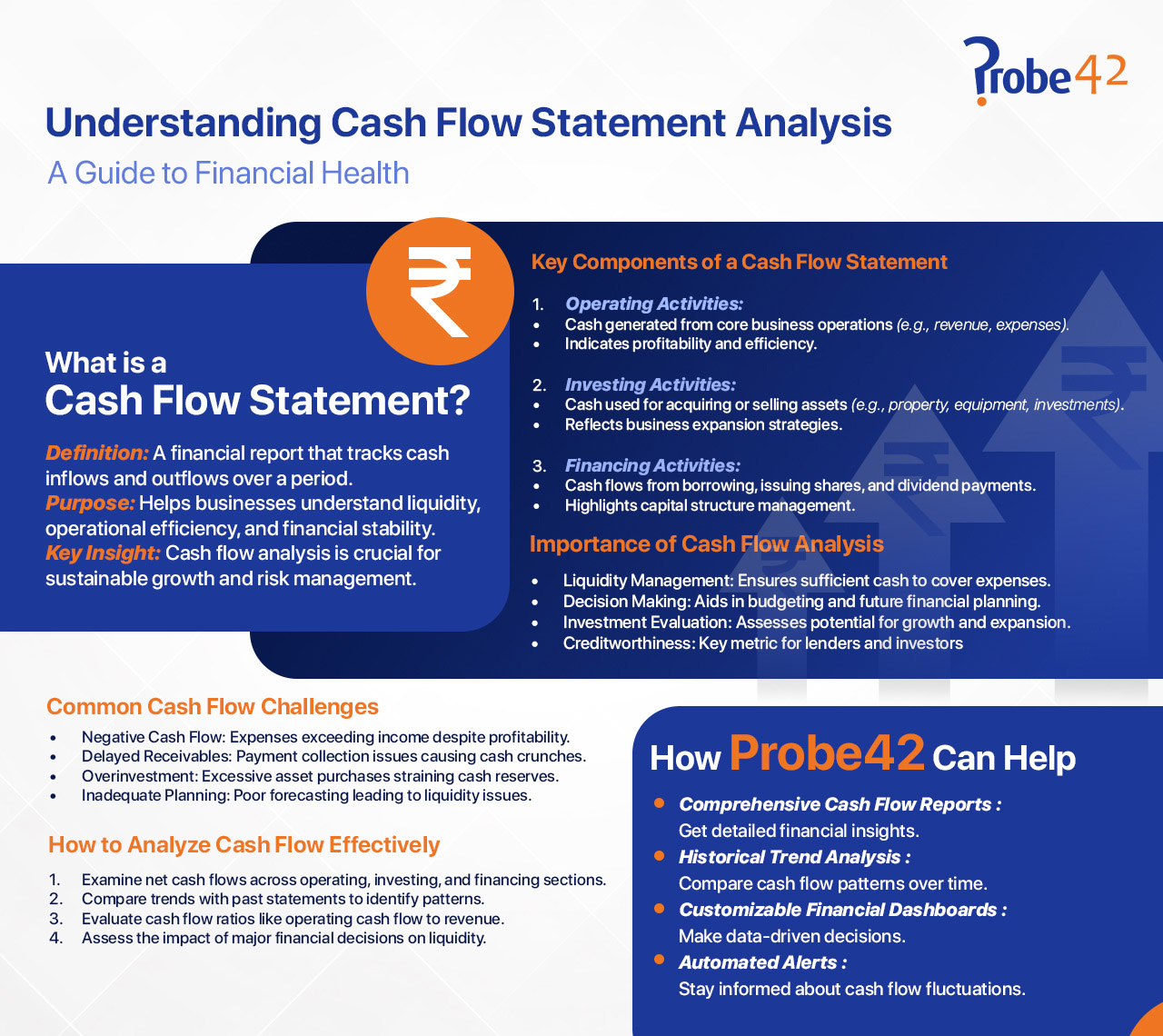

Cash Flow Statement: Definition

This statement is a financial report that shows a company’s cash inflows and outflows for a given period. The cash flow statement only looks at actual cash transactions, as opposed to the income statement, which also includes non-monetary items. This distinction is crucial as it helps in understanding the liquidity position of a business.

3 Types of Cash Flow Statements

There are three main types of cash flow statements:

1. Operating Activities:

The cash generated or expended in the primary business operations is tracked in this area. It consists of supplier payments, employee salaries, and revenue from sales of goods and services.

2. Investing Activities:

The cash flow from asset purchases and sales is monitored in this section. It covers deals including the acquisition or disposal of investments as well as real estate, machinery, and equipment.

3. Financing Activities:

The cash flow from dealings with the company’s creditors and owners is described in this section. It covers paying dividends, taking out and returning loans, and issuing and buying stocks.

Importance of Cash Flow Analysis

The unquestionable significance of cash flow analysis lies in the fact that it offers crucial insights into a company’s financial health and operational effectiveness. Here are some key benefits:

1. Liquidity Assessment:

By analyzing the cash flow statement, businesses can determine their ability to meet short-term obligations. This is important for maintaining solvency and better preparing for financial distress.

2. Investment Decisions:

To make wise choices, stakeholders and investors consult cash flow analysis. An organization’s capacity to produce enough cash flow from operations is an indicator of its financial stability.

3. Operational Efficiency:

Businesses can find areas where money is being spent inefficiently by doing regular analysis. Better cost control and resource allocation may result from this.

4. Risk management:

Predicting possible cash shortages is made easier by having a thorough understanding of cash flow trends. Companies might reduce expenses to reduce risk or take proactive steps to obtain funding.

Cash Flow Statement Analysis & Interpretation

Effective cash flow statement analysis and interpretation involves a detailed examination of each section of the statement. Here’s how businesses can approach it:

1. Operating Activities Analysis:

Analyze the net cash provided by operating activities. A consistent positive cash flow from operations is a strong indicator of a company’s core business strength. Look for trends over time to understand if the business is consistently generating cash.

2. Investing Activities Analysis:

Review the cash flow from investing activities. High capital expenditure might indicate growth and expansion, but excessive spending without corresponding revenue growth can be a red flag. Analyze the nature of investments and their potential returns.

3. Financing Activities Analysis:

Make sure to analyze the cash flow from financing activities to understand the company’s funding strategy. Positive cash flow from financing might indicate new borrowings or equity infusion, while negative cash flow could mean debt repayment or dividend payouts. It’s essential to balance these activities to maintain financial stability.

Cash Flow Statement Analysis: Future Trends

As businesses evolve, so do the methods of cash flow statement analysis. Here are some new-age trends that businesses must stay updated on:

1. Integration with Technology:

The use of AI and machine learning in financial analysis is becoming more prevalent. These technologies can provide real-time insights and predictive analysis, enhancing the accuracy of cash flow forecasting.

2. Sustainability Reporting:

There is a growing emphasis on incorporating sustainability metrics into financial reports. Businesses are starting to analyze cash flow in the context of environmental, social, and governance (ESG) factors.

3. Global Standardization:

Efforts are being made to standardize cash flow reporting across different countries. This will improve comparability and transparency for global investors.

4. Enhanced Visualization:

Advanced data visualization tools are making cash flow analysis more accessible. Interactive dashboards and visual aids help stakeholders better understand complex cash flow data.

Key Features of Cash Flow Statement Analysis

1. Detailed Breakdown of Cash Flows:

The analysis helps track the cash generated or used by a company’s core business operations. It records cash flows from buying and selling assets, such as property, equipment, and investments. It highlights cash flows from transactions with the company’s owners and creditors, including issuing or repurchasing stocks, borrowing, and repaying loans.

2. Cash Flow Forecasting:

It predicts future cash inflows and outflows to aid in planning and decision-making. The analysis also helps businesses prepare for periods of low cash flow and identify potential liquidity issues.

3. Liquidity Analysis:

It assesses a company’s ability to meet short-term obligations and also determines if a business has sufficient cash to cover operating expenses and debt payments.

4. Comparative Analysis:

It allows comparison of cash flows over different periods to identify trends. The analysis also facilitates benchmarking against industry peers to gauge performance.

Cash flow statement analysis offers a clear view of a company’s liquidity and financial health, enabling better decision-making and risk management. Platforms like Probe42 are at the forefront of this evolution, providing businesses with the tools they need to thrive in an increasingly complex financial landscape.

Conduct Cash Flow Statement Analysis with Probe42

By integrating information from 744+ validated public sources and employing AI-powered data cleaning, Probe42 ensures you have access to the most up-to-date and reliable information to make informed business decisions. It is used by a variety of users, including banks, businesses, professionals such as chartered accountants and lawyers, and fintechs.

With Probe42, gain instant access to comprehensive financial data dating back to 2006. Retrieve real-time corporate information, including balance sheets, profit and loss statements, and cash flow statements. Access director details, shareholding structures, compliance checks, charge details, and more. Equip yourself with valuable insights for informed business decisions and thorough due diligence. Explore deeper insights here

==

Data Source:

https://spend.usbank.com/blog/cash-flow-monitoring-strategies-for-small-businesses-tips-and-best-practices/